Elevate Your Career with B.Com PA with CA: Explore Our Expertly Crafted Course Website - Dive into the world of commerce and accountancy with our comprehensive B.Com PA with CA program. Gain practical skills, financial acumen, and professional insights to excel in the dynamic field of chartered accountancy. Explore our website for detailed curriculum, faculty expertise, and enrollment information.

Students who have completed their higher secondary education in any of the recognized streams such as state boards, CBSE, ICSE, and International Baccalaureate can join B.Com. PA. The focus of this course is to prepare and facilitate students in pursuing professional accreditation exams in addition to the undergraduate degree.

In addition to traditional undergraduate coursework, the primary focus of B.Com. PA is to prepare students for professional accreditation exams, such as those offered by institutes like the Association of Chartered Certified Accountants (ACCA), Chartered Institute of Management Accountants (CIMA), and others. These professional qualifications enhance the students’ employability and credibility within the accounting and finance industry.

The Course provides higher degree programs in respective subjects as a Masters’s degree, etc., and then for further research work. They can find job opportunities in a variety of environments in university, research, private and public industries, government departments, business organizations, and commercial organizations. A graduate after completion of his/her program can initially join as a trainee or an accountant and also seek employment in various government and private sectors, public accounting firms, marketing firms, budget planning, and consultancies.

The Rathinam group of institutions take great pride in a strong network of alumni who have successfully navigated the world of work and professional standing, often adorning the mantle of leadership. For a BCom PA student, options galore after graduation that include but is not limited to

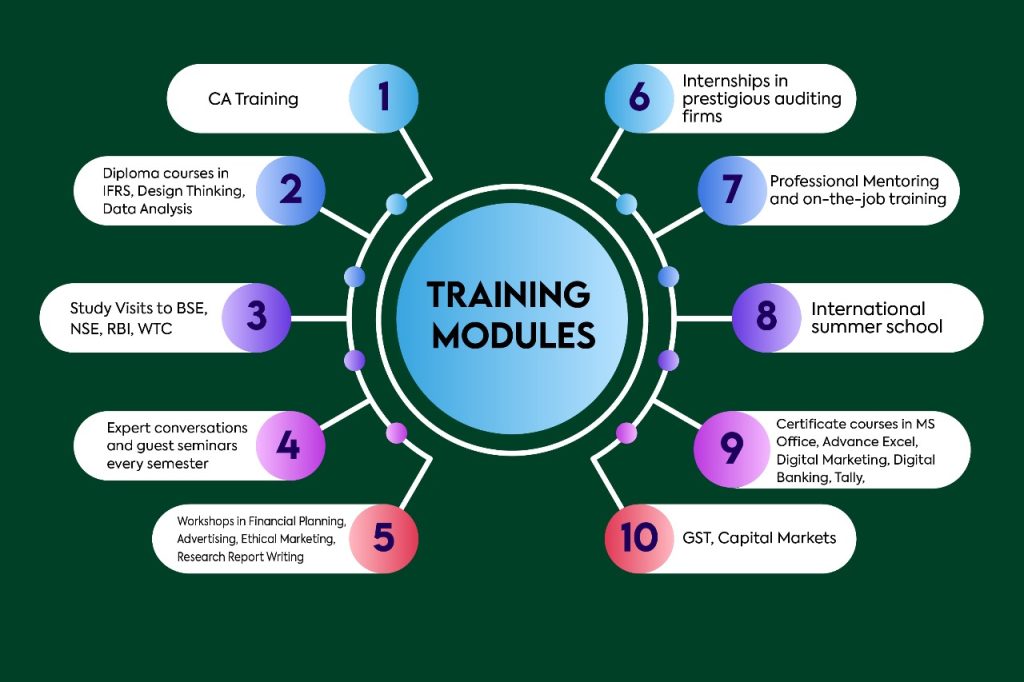

At Rathinam, the mode of course delivery is through Edge and Edge+ design that provide a wide array of choices for students, that are compatible with their aptitude and flexible for customization. As a result, students experience their three years of undergraduate education in alignment with their pace of learning and academic goals. In order to deliver the pedagogy, the School of Commerce has partnered with reputed national and international educational institutions to share expertise in a wide-ranging manner.

The Bachelor of Commerce Professional Accounting (BCom PA) at Rathinam is a three-year undergraduate course that aims to impart thorough subject knowledge spanning theory, principles, methods and procedures in the field of Commerce and Accounting.

The main objective of this track is to prepare students to take up challenging and rewarding professional career options in Commerce and its allied fields such as Accountancy, Taxation, Finance and related disciplines of Management studies.

The types of professional accreditation open to B.Com. PA students include Chartered Accountancy (CA), Cost Accountancy (ICWA), Company Secretaryship (CS), Chartered Financial Analyst (CFA), Chartered Management Analyst (CMA) and other types of professional career streams both nationally and internationally. More recently, emerging fields of application such as data science have also been incorporated into the course work.

Bachelor of Commerce offers a wide variety of specialization options, interactive learning experiences, and a strong commercial grounding in business. Considering the importance of self-employment, the program aims to develop and inculcate entrepreneurial skills among the students. Overall the course aims to work on the enrolled students to make them more productive, self-reliant, and constructive for self and society’s benefit.